Refund Frequently Asked Questions

Students

Students

When will I get my refund?

SSU begins term refunding the Friday after Financial Aid disbursement. Please review your financial aid disbursement dates for exact dates financial aid will pay onto the account. The Bursar's Office processes refunds each Friday. Processing can take up to 14 days from disbursement to refund of your student account. Once your student account has actual credit, not anticipated credit, disbursed onto your account, our office will be able to process your refund. **Non-refundable line items are not included in this process.

**Please note that some SSU loans disburse with multiple disbursement dates. Normally this occurs for first time loan borrowers, if you are borrowing this type of loan for the first time, or if you are borrowing a loan for one semester. These loans may have a 30 day waiting period to disburse or your loan may be split into two disbursements. SSU cannot refund until we receive more disbursed payment than your term charges.

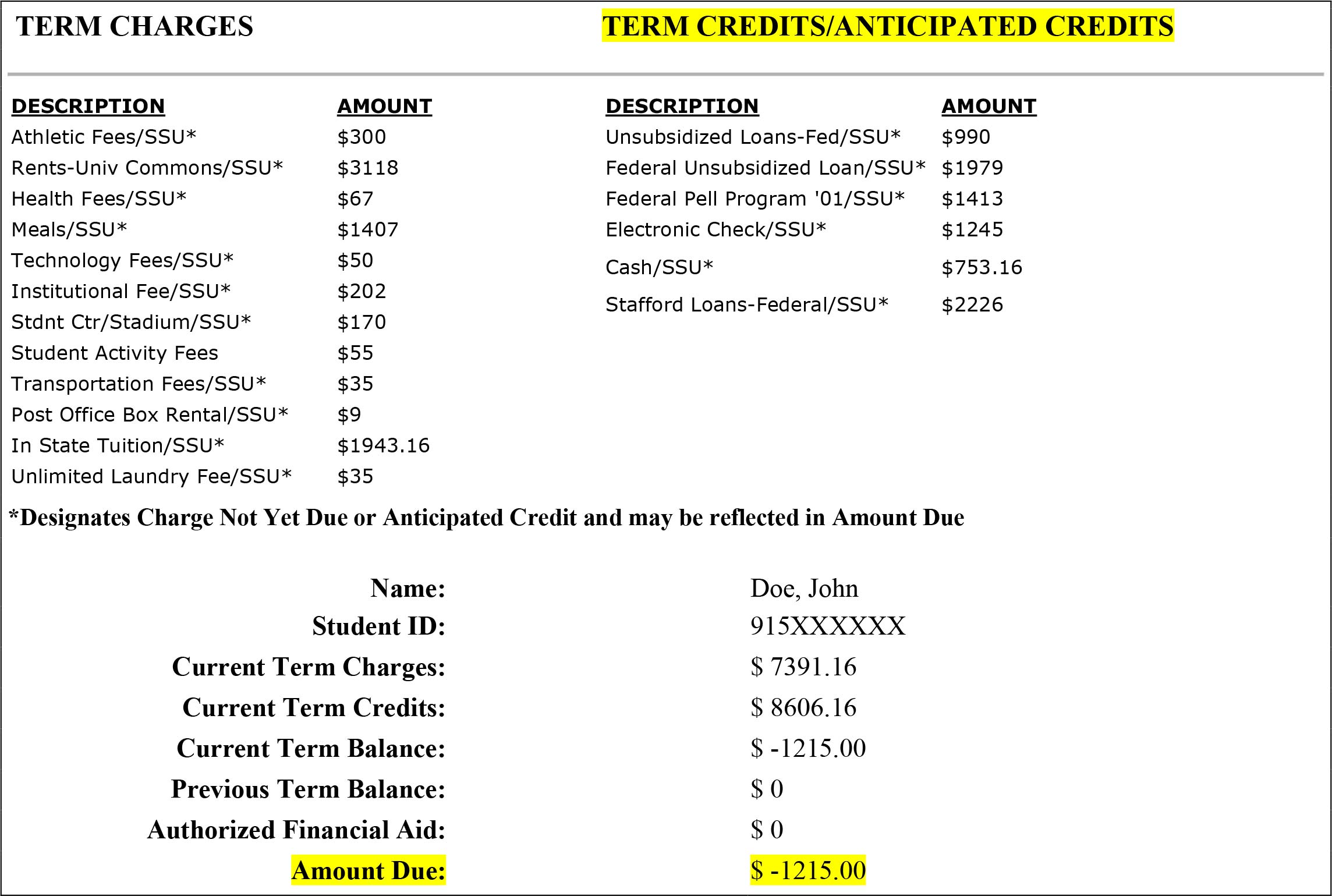

For example: Your credit balance due is $-1200. You took out a loan for $3000. Your loan is split into two disbursements. SSU cannot refund you the $-1200 until we receive both disbursements. Plan for the Friday after your second disbursement date as your refund time frame.

Your FIRST disbursement date only will appear in your Financial Aid Award in PAWS.

What does "disbursed to my account" mean?

When funds are disbursed to your account, it means that the anticipated credit actually paid towards your student account. It moves from anticipated to an actual credit. For more information regarding the disbursement of funds, please review this link.

What does it mean to have a negative amount due?

A negative balance indicates the amount of a refund due to you once your anticipated credit disburses. See above example.

*Please do not pay the negative amount due.

Why have I not received my refund and I have a negative amount due?

The "Terms Credits/Anticipated Credits" section of your Schedule/Bill will show you all the anticipated credits and actual credits that you have on your student account. Until all of your anticipated credits have disbursed/ received, SSU cannot refund you.

If you have a credit that is non-refundable, SSU cannot refund you from that line item.

What is a non-refundable line item?

Certain scholarships cannot exceed your overall term charges or cannot exceed the term charge for specific items like tuition. For example, the HOPE Scholarship pays a particular amount per credit hour for tuition only. If you drop a course, your HOPE scholarship will need to be adjusted from the Office of Financial Aid. This adjustment is not automatic. You may have a negative balance until that financial aid adjustment can be completed.

Currently, some Band, Honors, and Foundation scholarships are non-refundable. Refer to your scholarship offer for details.

Adjustments will not be made to your financial aid award until after disbursement of funds has occurred and a refund credit has officially been processed. Thank you for being patient while these manual adjustments are being made. For questions email finaid@savannahstate.edu.

How will I get my refund?

Refunds are processed via the e-Refund preference selected in your student account. You must establish an e-Refund profile in your PAWS. Select the View & Pay Your Tuition link and then Refund profile.

I didn't get my refund check. What do I do?

Email bursar@savannahstate.edu with your information so that we can research your refund and provide the best resolution for your unique situation.

If your refund was processed via mailed paper check and the check was not received, we must wait 14 business days to request a void and reissue request with our bank. We can then reprocess your refund. This way you can either have your refund direct deposited or we can mail you a new check. Ensure that your mailing address has been updated in PAWS so the new check will have the updated address.

If your refund was processed via e-Refund, the funds may not display in your bank until 3-10 banking days from when the refund was processed. Please be mindful of bank holidays regarding banking processes. You should receive an automated email once SSU has processed your refund and sent to our bank for processing.

If your refund was processed via e-Refund and it has been more than 10 banking days, reach out to your bank to investigate why the funds have yet to be received. Our office can confirm the routing and last 4 digits of the bank account deposited but once the funds are submitted to your bank, you will need to investigate further with your bank.

Why was my refund amount changed from when I last reviewed my account?

A change was either made to your student account charges or terms credits/anticipated credits. Review your On-Demand Statement for your current account information. Compare that information with your statements in your Statement History on your student account.

Common charge changes are bookstore charges, adding a course to your registration, getting a conduct fine assessed, or dropping a course. Any course changes will affect your financial aid calculation. Some types of aid are credit hour specific. Others you must be in so many credit hours to maintain that type of aid. Review our Financial Aid website to learn more about why your aid may have changed due to registration activity.

What is bookstore credit and how will it affect my refund?

Students who are expecting a refund from their financial aid funds may use up to $800 in the University Bookstore as a book store credit. Students with a book store credit for a semester have a limited time to utilize the credit before it expires. It is important to note that changes to your enrollment, aid, and/or eligibility may result in you still owing a balance if the credit is used before the changes are reflected on your invoice.

Students that have third-party vouchers covering book and supplies may use up to the amount that is designated on the voucher. Vouchers must be submitted to the Bursar's office via email to bursar@savannahstate.edu or third-party portal prior. The Bursar's Office has to coordinate with the University Bookstore for voucher credit so please expect a two day process before voucher credits can be utilized.

The time frames for the all bookstore credit are listed below:

Summer- May 1- May 26

Fall- August 1- 25

Spring- January 2- January 19

Only the usage in the bookstore will be charged to your student account. These charges will reduce your credit balance due, reducing your expected refund amount.

If we must evacuate for a hurricane will I get my refund prior to leaving campus?

Hurricane season is June 1 through November 30, with the most activity in September. Due to the fact that Fall refunds begin in this season, we could run into an occurrence where the University would be required to evacuate for the hurricane during this time. Our office MUST wait until attendance verification is complete and financial aid disburses to begin refunds, which occurs the first two weeks of the semester. We will then process all refunds via direct deposit. We cannot guarantee that USPS will be running in all locations during a hurricane so we encourage ALL students to establish an e-Refund profile. This way we can still deposit your refund into your bank account without interruption. We cannot guarantee refunds will be processed prior to an evacuation, however we will work towards expediting this process if an evacuation is to occur.

I withdrew from one of my classes. Will I get a refund?

You must drop a class during the drop/add period published on the academic calendar to have the charges removed from your student account. All other course withdrawals will not reduce or adjust your student account charges.

If I withdrawal from the semester will I get a refund?

Student accounts are recalculated up to 60% of the term. (This is usually around midterms.) Your tuition and fee charges will be recalculated from the last day your faculty reported you in attendance. Your housing and meal plan charges may be recalculated from the day your returned your keys after your move-out inspection.

After your student account charges have been recalculated, your financial aid/ account credits will be reviewed and re-evaluated. This means that your aid award will also be recalculated to the last day your faculty reported you in attendance.

If you received a refund, you may owe a portion of that refund back to SSU due to these recalculations.

Withdrawal recalculation can take up to 45 days from withdrawal to fully process.

Where are ATMs located?

Parents

How much is my student getting back as a refund?

Student's financial data is protected with the Family Education Rights and Privacy Act (FERPA), which affords students certain rights with respect to their education records. Students can establish others as Authorized Users on their student account so that others can view account balance and credits, make payments, and view tax statements. Without being on the student's FERPA waiver, SSU employees are not permitted to disclose account information.

How can I receive my refund via direct deposit?

Your student MUST establish you as an Authorized User in their student account with the e-mail address listed on their parent loan application. Once an Authorized User is established, setup an e-Refund on your Authorized User profile with your direct deposit information. The Authorized User setup with ask you to confirm a few questions from your PLUS loan application. Your answers MUST match our application for your refund to have direct deposit privileges. Without matching information, a paper check will be mailed to your address listed on the loan application.

Where will my PLUS loan refund be mailed to?

Your PLUS loan refund will be mailed to the address listed on your parent PLUS loan application.

How can I update my parent PLUS loan refund mailing address?

To update mailing addresses before a refund is processed, parents must e-mail finaid@savannahstate.edu, with a copy of their ID, from the e-mail address listed on their parent loan application. Address changes received after refunds are processed, will be reissued within 14 days of the funds being returned to the institution.

How can I allow my parent PLUS loan refund to go to the student?

To update PLUS refund to student authorizations before a refund is processed, parents must e-mail the Office of Financial Aid, finaid@savannahstate.edu, with a copy of their ID, from the e-mail address listed on their parent loan application that you wish to change your refund preference.

Once a refund has been processed to a parent, the refund may not be able to be stopped and reissued to a student.

Changes to who receives the refund can be made for future disbursements by e-mailing the Office of Financial Aid, finaid@savannahstate.edu, with a copy of their ID, from the e-mail address listed on their parent loan application that you wish to change your refund preference.

I didn't get my refund check. What do I do?

Email bursar@savannahstate.edu with your information. We must wait 10 business days to request a void and reissue request with our bank and then our team will reprocess your refund. This way you can either have your refund direct deposited or we can mail you a new check.